Information Systems and Project Management

Cost of investment

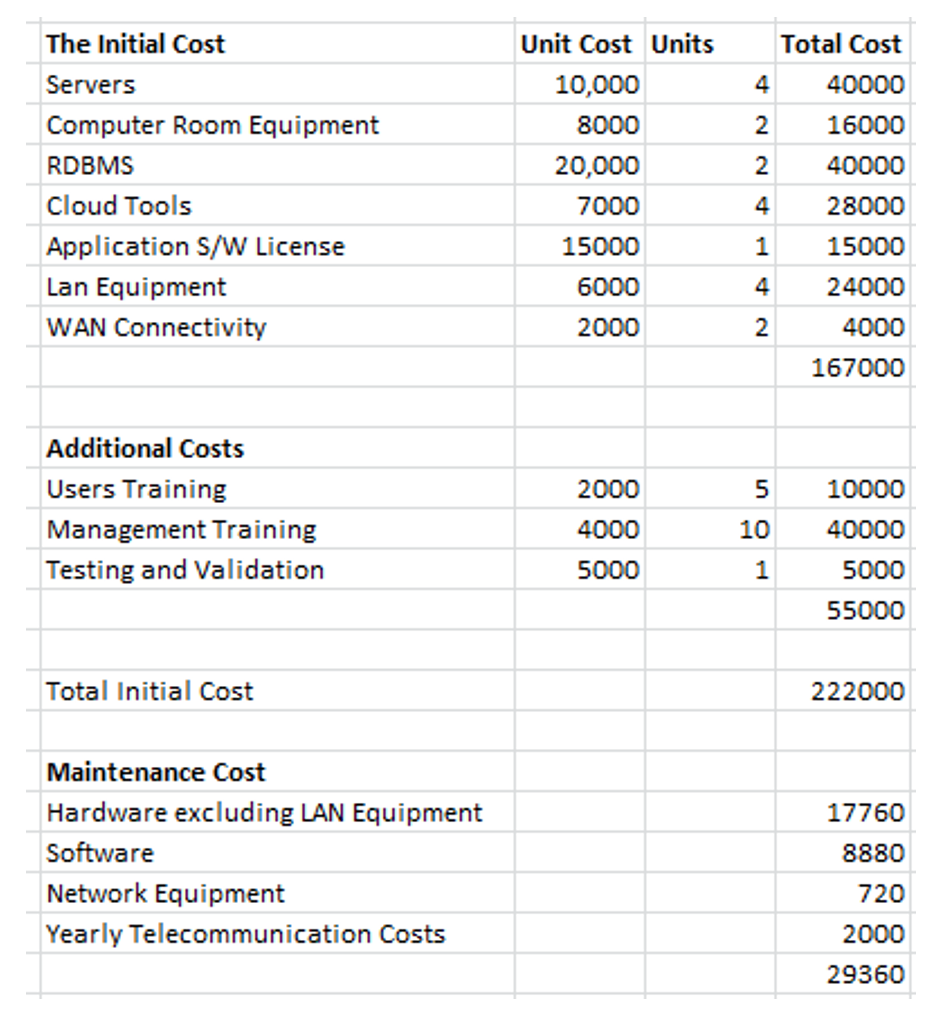

The enterprise company has decided to move from the old information system over to the cloud system. The total cost of investment can be separated into two different areas: the cost of fixed assets i.e. the cost of buying the subsystems of the cloud, the training and installation costs. The costs for training validation and testing will be capitalized in this case because this cost is incurred for the first time. Other than that, these costs are directly attributed to installation of the cloud technology and without them the system cannot be brought into its present use.

The initial cost of acquiring all the equipment that is required to run the cloud system is 167,000. This mainly includes all the fixed assets such as servers, computer room equipment. Cloud tools etc. The installation process takes 6 months after which the testing and training phase starts. The cost of getting the staff trained and testing the equipment is 55,000. The total cost of investment of moving to the cloud system is 222,000.

Other than these, the maintenance cost will also be incurred at the end of the first year when the installation and training have been done. However, the maintenance cost cannot be capitalized and will not be included in the cost of investment because this is not a part of acquisition. It is incurred once the system has been installed and tested. This is more of an expense rather than investment. And even when this cost had not been incurred the system had been brought into usable condition. This amount of 29,360 is not an investment cost but it is very well a part of cash outflows because it is linked to the cloud system. While, calculating the Net present value this cost will be treated as a cash outflow in the first year.

NPV & IRR analysis

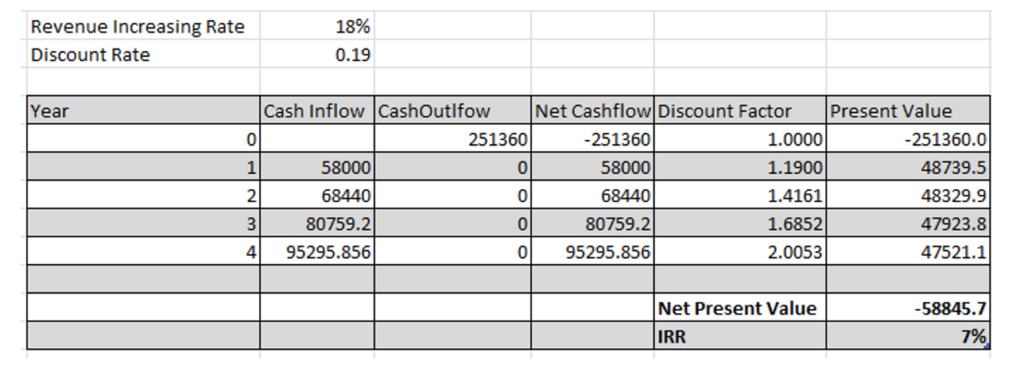

By installing Over the Cloud, the company can increase its revenues; however, detailed calculation shows a negative Net Present Value i.e. the initial cost of investment is greater than the present values of the future cash inflows of the project.

By investing in over the cloud, the revenue generated increases by 18% every year from the base value of 58000 for 4 consecutive years. And the only cash outflow that occurs in this project is in year 0, which is the cost of installation along with the investment cost and the maintenance cost. By using the discount rate of 19%, the NPV of the project turns out to be (58,845) which is a great loss to the enterprise firm. This means that by shifting to over the cloud the company will face a loss as they will have to pay an amount that is higher than the worth of the investment which will lead to a decrease in the wealth of the company.

The Internal Rate of Return is also calculated at 7% which means the company should only invest in over the cloud technology if the discount rate is at 7%. And even at this percentage the NPV will be zero i.e. no positive returns from investment. This will be the break-even point for investing in the technology. The company should only invest in the project if the discount rate is lower than the IRR of 7%. Only then can the company generate positive returns from investment.

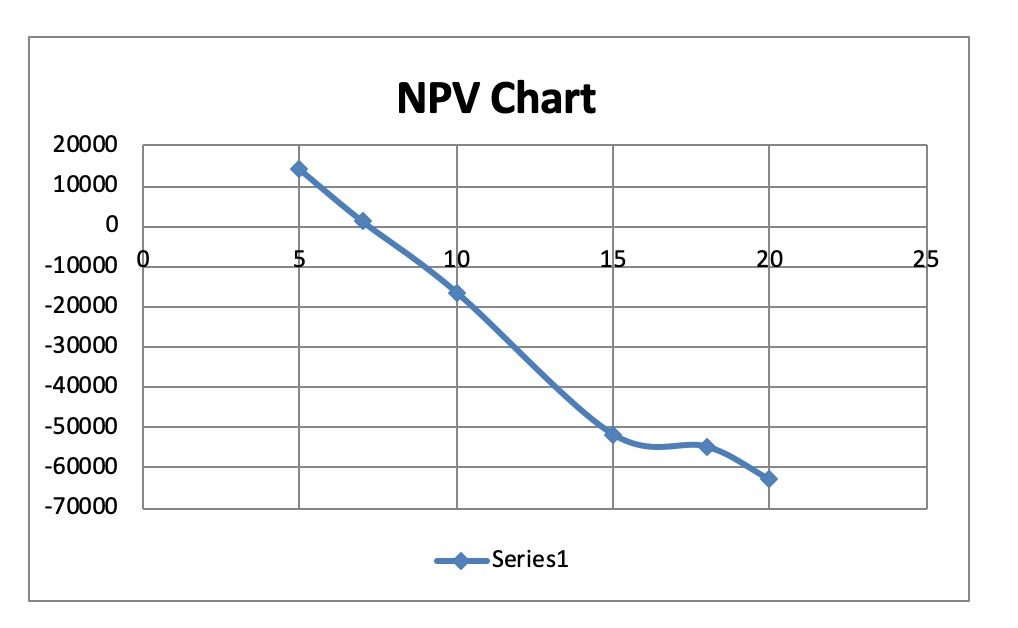

The NPV chart above shows that as the discount rates rises the NPV falls down and as the discount rate falls down the NPV increases. At the rate discount rate of 5% NPV is the highest, at 7% the NPV is 0 and so on. The graph also depicts that the company’s discount rate of 19% generates a highly negative NPV and is far away even from the break-even point.

Payback period analysis

Other than these two, the payback period of the investment is around 3 years and 5 months. Payback period counts for the period after which the initial investment has been recovered. Although there is no positive value generated at this point but the initial cost incurred has been recovered at least. A period of 3.4 years is quite high in comparison to the total time period of the project which is just 4 years.

The discounted payback method which is an ever more accurate method as compared to payback method also gives a time period of 3.2 years. The main difference between payback and the discounted payback period is that this discounted payback period takes into account the time value of money. But even that gives an answer of 3.2 years which is again too long as compared to the 4 years of the project. It means that it will take around years and 3 months just to recover the cost. So it is highly likely that the NPV of the project will be negative.

Investing decision

Looking at the negative NPV, an IRR of 7% which is too far from the cost of capital and a high payback period the company should avoid investing in over the cloud technology as the returns are not worth it. The cost of initial investment is far greater than the net present values of the future cash inflows.

However, it is important to note that the NPV and IRR are merely numerical methods of deciding whether a project should be taken upon or not. There are other strategic decisions which need to be taken by a business in order to grow or survive into the market. For a company like this, shifting to over the cloud system can be really important even with a negative NPV because competitors might have been shifting and in order to survive in the market they would want to invest. Or in another scenario, the company might have an aim of getting ahead of its competitors as a result it would invest in the project even when the IRR is so low as compared to the present discounting rate. They might be able to provide customers, the service levels which are far better than the competitors and this can help them gain a greater market share. Therefore, in the long run the revenues can turn out to be much higher and this can lead to a greater growth for the company. Even when the chances of growth are low the company might have to accept the project in order to respond to the competitors. For a technology business like this, it is really important to be at pace with the current market trends because these projects might be linked to other future projects. It is usually assumed that projects with a negative present value usually lead to a lower shareholder wealth but it is important to consider the strategic options of growth and survival due to which a business has to invest under any circumstances.

The strategic options also depends if the company has extra finances. If the company has extra money then this project even with a negative NPV might not hurt as it will serve as a great experience to the business. The staff which itself is an important asset of the business will be more trained and learned.

But at the same time the enterprise company must take into account the opportunity cost of this investment. There might be other projects that the company needs to invest in. The company might need capital in future and if it invests now it might be short of capital in the later years.

It is also important to highlight the fact the future revenue at which the NPV is calculated is merely an estimate. The NPV calculated is based on estimated revenue. Once the project is taken and over the cloud technology is installed there might be higher revenue depending on the market situation. Also, the market condition has a great effect on the cost of capital. The interest rates fluctuate abruptly as a result of which the estimates might go wrong. This means that the actual value generated from the project can be different from the expected net present value. In other words, the NPV is highly sensitive to the interest rates.

Conclusion

Looking at the overall picture, the enterprise should not invest over the cloud computing at this point in time because the cost of capital is quiet high which leads to a very low NPV and the increase in revenue does not overcome that. Other methods such as the IRR method also comply with NPV. Moreover, currently there is no information about the competitors or market trends therefore based on the financial analysis this project is not a good investment as it doesn’t generate positive returns.